What is the National Social Security Fund (NSSF)?

The National Social Security Fund is a fund established for the well-being and protection of employees and workers. At present, it focuses on providing employment injury insurance to workers.

What laws set the NSSF?

The Law on Social Security Schemes for Persons Defined by the Provisions of the Labour Law was passed by the Parliament in September 2002. The sub-decree concerning the establishment of the National Social Security Fund (NSSF) was adopted in 2000. The NSSF, which is an independent and autonomous public institution, was established in order to administer the schemes of Social Security protection in accordance with the law and was fully functional at the end of 2008.

Who is covered in the NSSF?

The NSSF only applies to enterprises and establishments with 8 employees and more. Workers in these enterprises and establishments include:

- All workers defined by the provisions of the Labor Law, if those persons perform work in Cambodia in an enterprise or establishment of nature, form and validity of the contract or kind and amount of the wage received by the person,

- Trainees, apprentices and persons who are attending rehabilitation center.

- Seasonal or occasional workers

NSSF also applies to state workers, public workers and every personnel who are not governed by the common statute for civil servants or by the Diplomatic statute as well as officials who are temporarily appointed in the public service.

Who pays and how much?

Employment injury is regarded as an employer's responsibility. The reason is that the employer is the one who creates the jobs for employees, and at the same time he/she also creates the occupational risk. As a result, all contributions to the NSSF are borne by the employer.

The contribution is a uniform rate applied to all risk class or industry. All employers pay 0.8% of the assumed wage based on the employee's monthly wage before taxation.

Employers can make the payment through ACLEDA bank, which has branches in all provinces in Cambodia. Then, bring the bank slip along with the required documents to NSSF.

Table of Contribution For Employment Injury Insurance Scheme

| Monthly Wage (Riel) | Assumed Wage (Riel) | Contribution (Riel) |

| Below 200,000 | 200,000 | 1,600 |

| 200,001-250,000 | 225,000 | 1,800 |

| 250,001-300,000 | 275,000 | 2,200 |

| 300,001-350,000 | 325,000 | 2,600 |

| 350,001-400,000 | 375,000 | 3,000 |

| 400,001-450,000 | 425,000 | 3,400 |

| 459,001-500,000 | 475,000 | 3,800 |

| 500,001-550,000 | 525,000 | 4,200 |

| 550,001-600,000 | 575,000 | 4,600 |

| 600,001-650,000 | 625,000 | 5,000 |

| 650,001-700,000 | 675,000 | 5,400 |

| 700,001-750,000 | 725,000 | 5,800 |

| 750,001-800,000 | 775,000 | 6,200 |

| 800,001-850,000 | 825,000 | 6,600 |

| 850,001-900,000 | 875,000 | 7,000 |

| 900,001-950,000 | 925,000 | 7,400 |

| 950,001-1,000,000 | 975,000 | 7,800 |

| 1,000,001 up | 100,00,000 | 8,000 |

What benefits do workers get from NSSF?

NSSF provides compensation to all NSSF members who suffer occupational accident. The compensation or benefits are categorized as followings:

- Medical treatment benefit

- Temporary disablement benefit

- Nursing benefit

- Permanent disablement benefit

- Constant attendance benefit

- Survivors benefit

Injured employee is provided with medical treatment benefits including medical care and transportation. Temporary cash will be provided for the period of temporary disablement on the second day after the accident at a rate of 70% of the daily contributory average wage, and lasts for 180 days. Daily contributory average wage is the division of average assumed wage (of the last 6 months prior to the accident) by 30 days.

How to register?

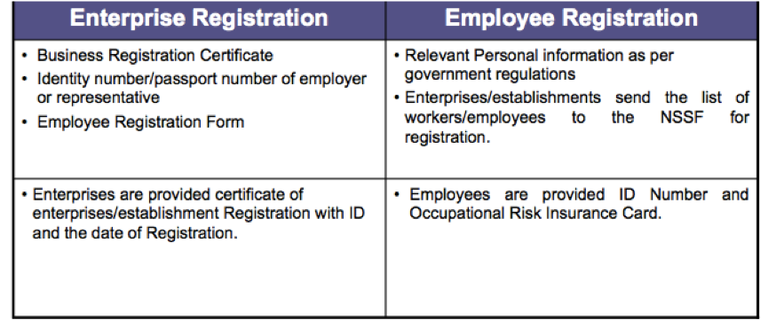

All enterprises and establishments hiring 8 employees or more, defined by the provisions of the Labor Law are obliged to register in the NSSF.Enterprises and establishments in operation shall register within 45 days at the latest after the effect of this Prakas (March 01, 2008). New enterprises and establishment need to register within 45 days of opening. The enterprise registration form and the employee registration form can be downloaded on the NSSF website. The registration with NSSF requires both the enterprise and the employee to register (through the employer) with the following information. The process is done simultaneously.